This year I had a goal of reading 5,000 pages of magazine and news articles (and a few blogs and academic papers). Happily I have completed this goal!

(My other goals were to study both math and programming every day of the year (success!) and listen to 500 hours of podcasts, I only hit 300).

A sub-goal, which I also completed, was to read the top 25 magazine articles ever written as determined by Kevin Kelly, founding editor at Wired. Kelly solicited hundreds of suggestions from contacts in the publishing industry and ranked the articles according to the number of recommendations. Of course, any such list is arbitrary, but as far as lists like this go it seems to be definitive (try Googling “best magazine articles ever” and his list comes up repeatedly. Other lists in the search results are publication specific, say, Esquire’s Top 10 Best Articles). Kelly’s list actually has hundreds of entries and I read a number outside of the top 25.

Because most articles these days are online my goal essentially translated into reading 2.5 million words. I decided early in the year on a figure of 500 words per page to make sure these were proper pages, not the 250-word, double-spaced pages we all wrote as high school Freshman.

If you’re curious this amounts to reading about 14 pages a day. Reading 14 pages isn’t so hard; doing it consistently can be very hard. If you go on a 3-day long weekend getaway that’s not suitable for reading, on the following Monday you need to read 56-pages just to keep up.

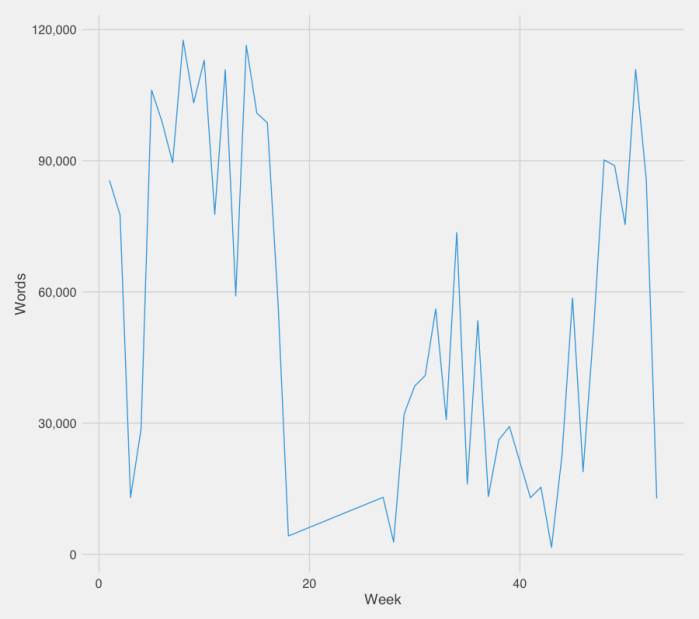

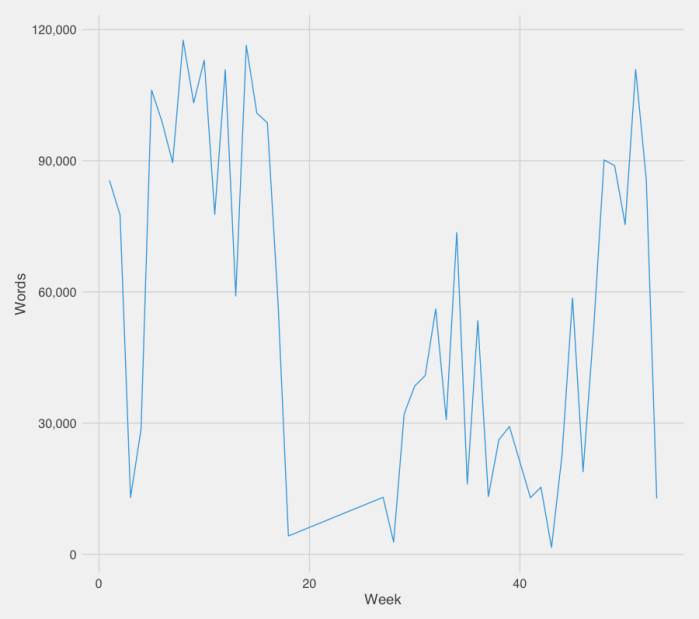

I was buoyed by a habit of 15,000 words a day for several months near the beginning of the year when I was toying with a goal of 10,000 pages. I think that goal is achievable, but not while trying to fit in a healthy dose of daily math and programming.

Here are some details about this goal along with some fun graphs and figures.

Methodology

I kept track of everything I read in a Google spreadsheet. I used the “Word Counter Plus” Google Chrome plugin to keep track of the number of words. To use the plugin you just highlight the words. One problem is that for many articles highlighting the article also highlights advertisement text and recommended reading lists. In these cases I would estimate the number of superfluous words highlighted and subtract them out.

In my spreadsheet I recorded the date, article title and publication, and a link to the article. I also kept track of my general feeling about the article on a scale of 1-10 and then a second rating of my feeling about the best or most interesting part of the article. I found this to be very helpful for personal organization! I plan to keep track of every article I read going forward as it makes rereading much easier. (Do you ever think, where did I read that? And can’t find it. Keeping track of what you’ve read helps a lot. It is also great to go back and see things you liked, but can’t quite remember so that you can reread them to refresh your memory).

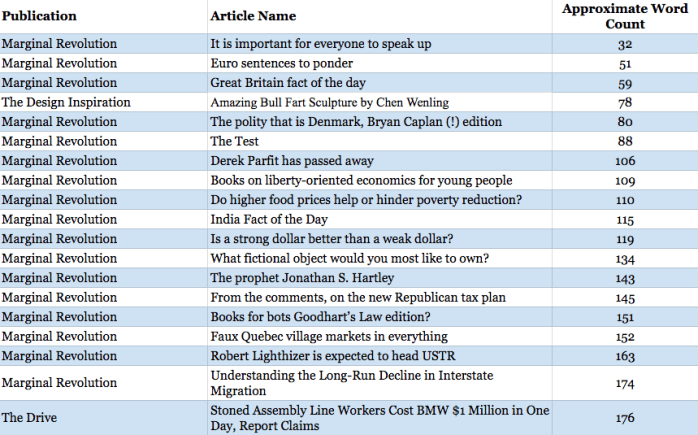

I didn’t actually record everything I read. Only articles I read in full were recorded, so any article I merely browsed — which is likely equal to the number I actually read — was not recorded. I also didn’t record articles that were too short. For example, I read Marginal Revolution daily, but recording dozens of 50-100 word blog posts quickly got tiring and so much of this reading simply went uncatalogued.

Likewise my list did not include any books I read or technical articles related to my goal of studying math and programming.

Sources

So where did I find the articles I read? Although I did not keep track of article sources in my spreadsheet here is a list from memory.

- If you don’t subscribe to The Browser and you like reading, I don’t know what you’re doing with your life. Just go subscribe. Pay the $34 annual fee, it’s worth it. (The browser sends a daily email digest).

- I subscribe to their weekly roundup of long-form articles, which I highly recommend as another great source of good writing.

Twitter

- I follow a bunch of different people who are always sharing articles. I find subscribing to smart people and reading what they are recommending to be a really great way to stay abreast of important conversations. Nuzzel is great app for consolidating what those you follow on Twitter are sharing the most.

Facebook

- Friends post articles and I follow a number of news outlets.

- This is my favorite blog and I read it daily. Tyler posts a list of daily links, which I often click and browse. I end up reading a number of them all the way through.

- I read all of the Top 25 articles listed on the main page and about 20 or so articles that were on the list, but outside of the Top 25.

Other Lists

- For example, I picked out articles to read from the Pulitzer Prize feature writer winners and various end of year “Best of 2017” lists. I ended up reading seven winners of the Pulitzer Prize in Feature Writing this year.

Things I’ve wanted to read for a while

- Several pieces I read this year I’ve been wanting to read for a while. Snow Fall and The Case for Reparations are two examples, both of which I’ve started in the past but hadn’t finished.

Looking for other pieces by an author I liked

- For example, I read a number of pieces by Chris Jones after reading two that I liked. Jones is easily one of the best magazine feature writers around today. Likewise Pablo Torre is one of my favorite hosts of PTI, so I looked up and read a number of his pieces. Torre is most famous for his Sports Illustrated article

References and Recommendations

Ideological Spectrum

I read across the ideological spectrum because there is good, cogent, interesting writing across the ideological spectrum.

What Did I Not Read?

So much! Just looking through the various “Best of 2017” lists I see that I missed a lot I hope to catch up on in 2018. There is simply too much good writing to read and more coming out everyday. I find it a bit sad knowing I won’t be able to read it all despite, or maybe because of, the amazing and enriching articles I read this year.

Stats

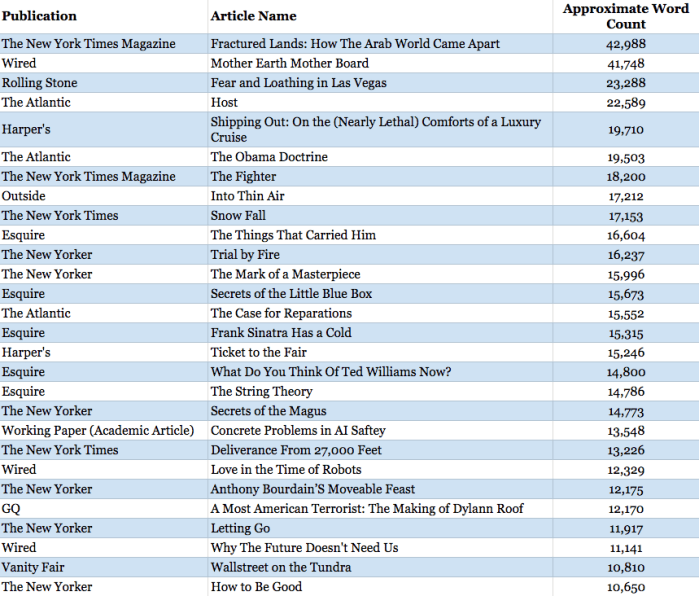

Here is a summary of this years reads. All told I read 1,085 articles totaling 2,529,738 words (5,059 pages). I read an average of 6,931 words (about 14 pages) a day. The average article length was 2,332 words. I read 260 different publications in total.

You can see from my weekly reading habits that I took some breaks from hardcore reading. During these times I was focusing more on programming.

What were the longest things I read?

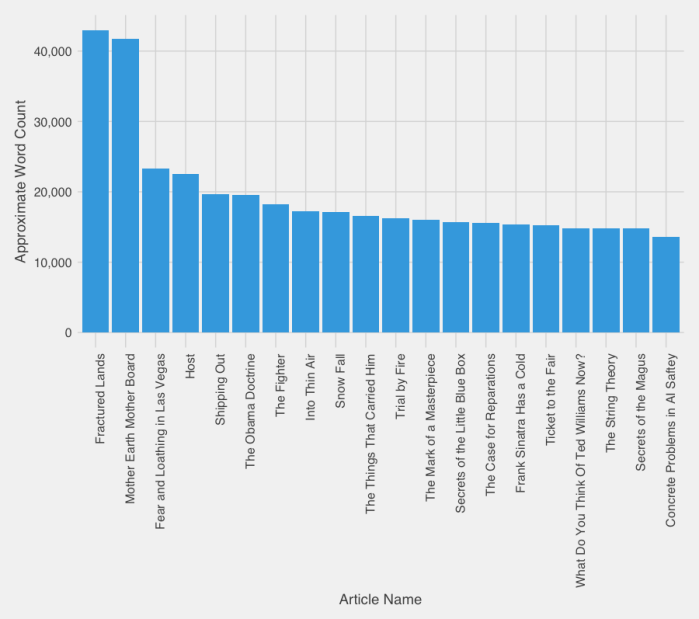

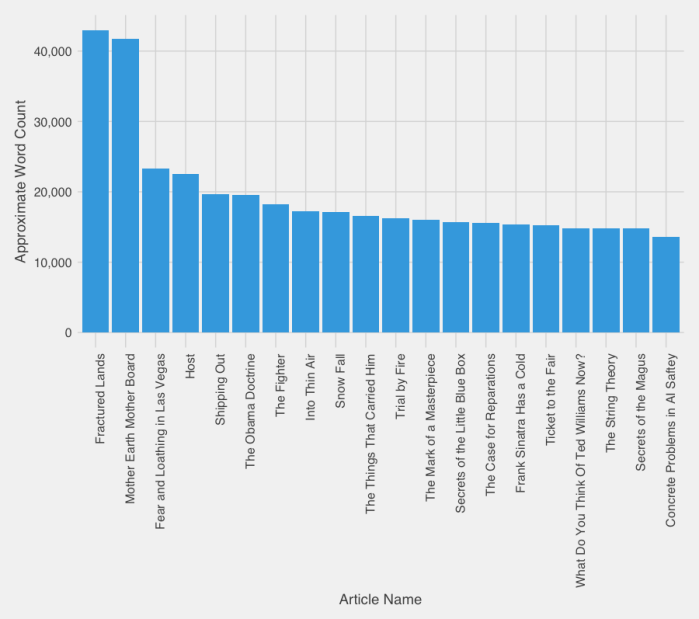

I had a good mix of long and short articles. The chart below gives a sense of the length of some of the longer pieces I read.

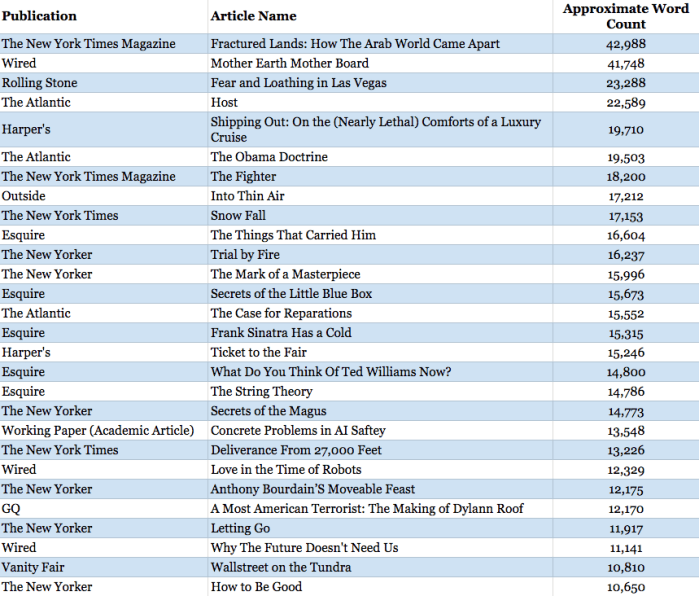

Below is the list of all articles I read that were over 10,000 words. Quite a few of them are classics (meaning they appeared on Kelly’s list) and a few more are Pulitzer Prize winners. The longest piece was “Fractured Lands” a 43,000-word (86-page) behemoth that took up the entire print edition of The New York Times Magazine the week it was published.

The next longest article was Wired’s famous “Mother Earth Mother Board” about the laying of underwater submarine cables. (For those that don’t know all intercontinental internet traffic goes through cables that are laid across the bottom of the ocean. Satellite transmission is far too slow and accounts for less than 5% of transmissions. See this short article for more details.) “Mother Earth Mother Board” came in a close second at 41,750 words.

Rounding out the top three was Hunter S. Thompson’s “Fear and Loathing in Las Vegas.” It was a paltry 23,000 words.

What were the shortest things I read?

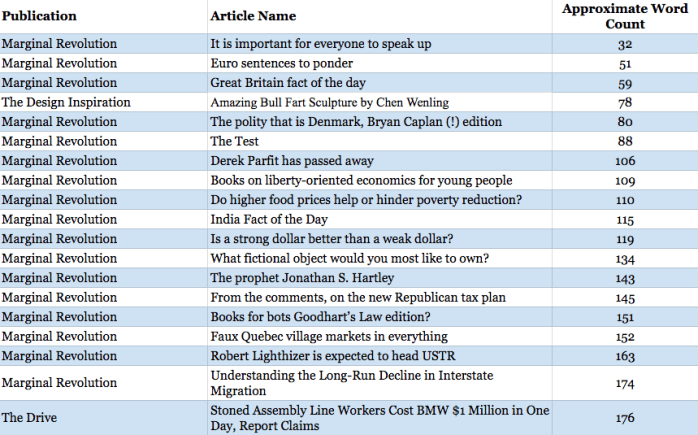

Glancing at the shortest things I read you can see why I stopped recording all my visits to Marginal Revolution. But don’t miss the “Amazing Bull Fart Sculpture by Chen Wenling” that I read in The Design Inspiration. (It’s actually a really amazing sculpture, you should check it out).

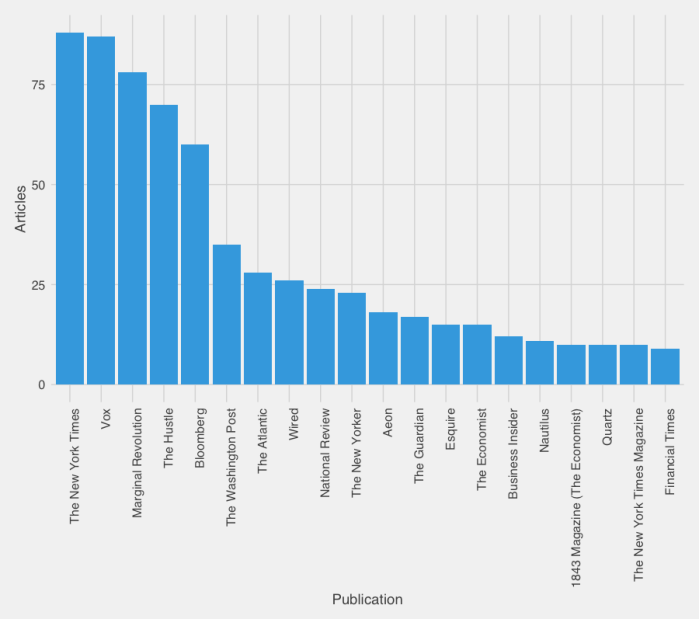

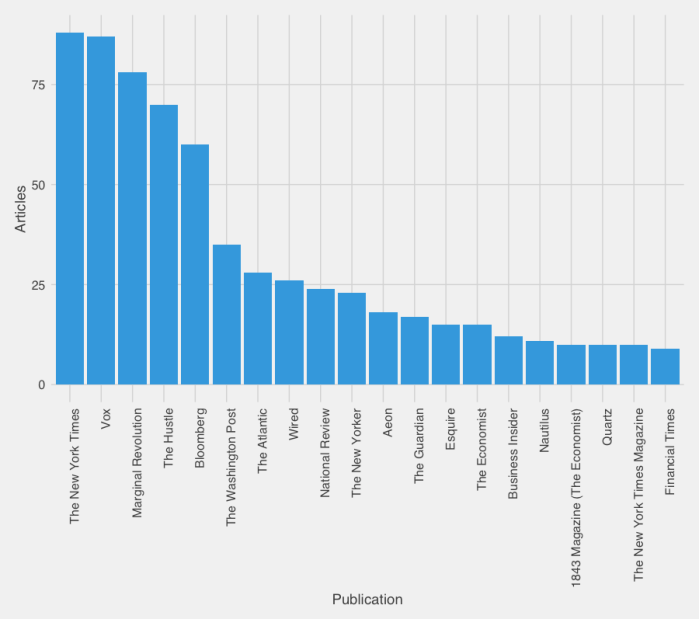

What publications did I read most?

I read 260 different publications in all. There is quite a long tale of publications I read only once. You will see some familiar names on the list below. Both Vox and The Hustle were buoyed by the fact that I subscribe to their email newsletter (same with Aeon, Nautilus, and the National Review).

Resources

Here are some supplemental resources that might be of interest.

Esquire Classics podcast series – Contains podcast episodes with the authors of many of the classic Esquire pieces cited here.

Longform – Contains podcast episodes with the authors of many pieces cited here (and many, many others).

Nieman Storyboard’s Annotation Tuesday – Contains annotated Q&A with many of the authors cited here.

Articles That Will Stay With Me

These are articles (outside of the Top 25) that will stick with me. I will tackle the Top 25 separately below.

Comedy

I don’t read much fiction, but these two stories from McSweeney’s are truly hilarious. I’m sure I missed many more wonderful stories in McSweeney’s.

I’m Wes Anderson, And I’m Directing This FBI Investigation Into Russia And The Trump Campaign, McSweeney’s (2017) – So accurate.

Though I Can’t Be Certain, I Suspect That This Hollywood Actress I’m Interviewing May Be Entertaining Thoughts Of Having Sex With Me, McSweeney’s (2017) – The inner monologue of men.

This story from SB Nation is truly hilarious.

I watched in bewilderment while a man tried to return butternut squash because he thought it was cheese, SB Nation (2017) – The greatest live tweet storm of 2017 annotated with behind-the-scenes notes.

Profiles

There are many profiles in other parts of this list, but here are a few I enjoyed this year.

Secrets of the Magus, The New Yorker (1993) – Mark Singer’s famous profile of the magician Ricky Jay.

The Fighter, The New York Times Magazine (2017) – C.J. Chivers won the 2017 Pulitzer Price in Feature Writing for this fantastic essay of Sam Siatta, a marine having trouble reintegrating after returning from Afghanistan.

Honorable mention: Anthony Bourdain’s Moveable Feast, The New Yorker (2017); A Most American Terrorist: The Making of Dylann Roof, GQ (2017); Jackie Chan’s Plan to Keep Kicking Forever, GQ (2017).

The Death Essays

Essays about death and dying, the fear of death, grieving for the dead, both young and old, and what it means to live a good life.

Letting Go, The New Yorker (2010) – A life changing essay by Atul Gawande on the way we grow old and what it means to have a good death. I am excited to read “Being Mortal” in 2018.

One Man’s Quest to Change the Way We Die, The New York Times Magazine (2017) – Jon Mooallem’s profile of B.J. Miller. A life changing essay on dying young and what it means to have a good death.

The Way We Age Now, The New Yorker (2007) – Atul Gawande on the way our body breaks down as we grow old. Aging is inevitable, dispiriting, and beautiful.

Fear Itself: Learning to Live in the Age of Terrorism, The Washington Post (2004) – On riding a bus in Israel. More broadly, a contemplation of whether the US was headed the way Israel in 2004. In Jerusalem residents live in constant fear of death by bombing, due to a pernicious sense of terrorism all around them: “See the stone lion on that building, four stories up? Body parts hung there from the second bombing of the 18 bus in ’96. Down the street, see the Sabarro sign? Fifteen dead, August 2001. It’s closed now. They moved it, but no one goes there anymore. That falafel place to the left? It exploded the same day as that pub over there. ”

The Things That Carried Him, Esquire (2008) – See description under the Top 25 section.

What Bullets Do To Bodies, Huffington Post (2017) – Profile of Dr. Amy Goldberg, a trauma surgeon at Temple University Hospital in North Philadelphia specializing in gunshot wounds. “Her religious faith is still strong—it’s not that she goes around talking about it, she told me, it’s just that she has worked for 30 years in trauma and seen a lot of death, and it’s hard to do that and not feel something about God.”

The Really Big One, The New Yorker (2016) – Kathryn Schulz won the 2016 Pulitzer Prize in feature writing for this story. I have been aware of this article for some time: I live in Seattle and it made the rounds last year (it’s all about how half the west coast, including Seattle, is at risk of a massive earthquake of unprecedented scale). I finally got around to reading it. It legitimately makes me want to move. If I start a family and raise kids how can I have them live in a place so destined for massive destruction?

Fatal Distraction: Forgetting a Child in the Backseat of a Car Is a Horrifying Mistake. Is It a Crime?, The Washington Post (2010) – See description under the Top 25 section.

Trial by Fire, The New Yorker (2009) – A now famous piece on whether Texas executed an innocent man. It contains a surprising lesson in arson investigation and the persistence of non-scientific mysticism in matters of grave importance. If this last part appeals to you see also David Grann’s 2010 The New Yorker piece, The Mark of a Masterpiece: The Man Who Keeps Finding Famous Fingerprints on Uncelebrated Works of Art and also John Oliver’s recent segment on forensics.

New Media Articles

Snow Fall: The Avalanche at Tunnel Creek, The New York Times (2012) – This piece won John Branch the 2013 Pulitzer Prize in Feature Writing. I’ve wanted to read it for some time, but only now got around to it. In 2013 it looked like the future of journalism. It was filled with topographical, animated maps; first-person video and audio; and interviews. This article hit home since it takes place on the back side of a mountain I skied numerous times near Seattle. It’s interesting to look back at Snow Fall in 2017. Features occasionally incorporate interactive elements, but more often they simply contain photos and charts. I suspect that the elements in Snow Fall are still expensive to create even in 2017 and so they are reserved for long-form articles with powerful bylines (John Branch also wrote “Deliverance From 27,000 Feet” and Ta-Nehisi Coates wrote “The Case for Reparations”).

Deliverance From 27,000 Feet, The New York Times (2017) – Think of this as Snowfall 2.0. It tells the story of the recovery of several bodies of West Bengali climbers that had died the previous season. Interactive elements are similar to Snow Fall.

The Case For Reparations, The Atlantic (2014) – I see Ta-Nehisi Coates’ project as mainly about brining Critical Studies to a broader audience. Little of what he says is new, but he writes about it for a public audience in a style that is elegant and searing. This piece contains video, interactive maps, and original documentation that can be examined.

Although I read it last year, see also Paul Ford’s famous Bloomberg 29-thousand word piece What is Code? The most sprawling piece of New Media I have ever seen, the print edition took up an entire Bloomberg weekly.

Articles About Technology

Google Maps Moat, Justin Obeirne’s Blog (2017) – A fascinating deep dive into how Google is combining satellite images and its own street view data to automatically create Areas Of Interest and highlight these regions for users. Obeirne also discusses how much better Google map’s data is than Apple’s and what Google might do next.

Neuroscience and the Law: Don’t Rush In, The New York Review of Books (2016) – Much of law focuses on intent. Two people that committed the same crime may be charged differently (involuntary manslaughter vs. murder, for instance). Some claim that new imaging techniques and understanding of the brain’s inner workings give us a deeper sense of whether someone intended to do an action. The author argues that these techniques are not yet mature enough to use in sentencing. Although he doesn’t mention it the author’s logic implies that one day in the future it may be appropriate and widespread to use various brain technologies to determine criminal intent.

Why AjitPai Is Right, Stratechery (2017) – Ben Thompson of the consistently good Stratechery gives a reasoned argument for why most people have net neutrality all wrong. I should say Thompson is very much pro-neutrality, but thinks the current discussions are missing a lot. I found this article very persuasive. For a more pointed critique directed at the media see Larry Downes Forbes article Why Is The Media Smearing New FCC Chair Ajit Pai As The Enemy Of Net Neutrality?

Estonia, the Digital Republic, The New Yorker (2017) – I have known for some time that Estonia is trying to create a forward looking, technological state (ex. blanketed internet in public spaces). The extent to which they have already done this boggled my mind. Estonia has already integrated nearly every piece of government information into a portal that every citizen has access to. This portal contains court records, school records, voting access, and much more. The main tenet of Estonia’s system is the once-only principle, meaning data should only need to be entered into the system once. Why enter a user’s address multiple times if that information already lives in the system.

Here is one representative passage: “The bigness is partly inherent in the government’s appetite for large problems. In Tallinn’s courtrooms, judges’ benches are fitted with two monitors, for consulting information during the proceedings, and case files are assembled according to the once-only principle. The police make reports directly into the system; forensic specialists at the scene or in the lab do likewise. Lawyers log on—as do judges, prison wardens, plaintiffs, and defendants, each through his or her portal. The Estonian courts used to be notoriously backlogged, but that is no longer the case.”

The Spy and Theft Stories

These were the most entertaining and fun pieces of the year. I loved them!

The Untold Story of the World’s Biggest Diamond Heist, Wired (2009) – This is like Mission Impossible or Ocean’s 11, except it’s actually real. This article is so, so good. You will not be able to stop reading it once you start.

Art of the Steal: On the Trail of World’s Most Ingenious Thief, Wired (2010) – This article was so outrageous I wasn’t sure if it was real. From the opening line you are put in the middle of unbelievable action that lasts the entire article. Also, so, so good.

How the CIA Used a Fake Sci-Fi Flick to Rescue Americans From Tehran, Wired (2007) – The article that served as the basis for the film Argo. Even having seen Argo I found this to be a fantastic and original read.

Inside Quebec’s Great, Multi-Million-Dollar Maple-Syrup Heist, Vanity Fair (2017) – There’s big bucks in syrup.

The Hijacking of the Brillante Virtuoso, Bloomberg Business Week (2017) – Like a classic spy movie only real. Full of corporate greed, clever investigatory techniques, and brutal murder.

The Untold Story of Kim Jong-nam’s Assassination, GQ (2017) – A stranger-than-fiction account of Kim Jong-nam’s assassination in the Kuala Lumpur International Airport by VX nerve agent. Kim is the older half brother of Kim Jong-un, the current North Korean Dictator. The assassination was expertly planned, so much so that the two killers had no idea they were involved in the plot.

Stealing Mona Lisa, Vanity Fair (2009) – A thrilling tale of the 1911 theft of the Mona Lisa and its subsequent return.

Diary, London Review of Books (2017) – Alexander Briant’s diary of an investigation for a major oil company in Port Harcourt, Nigeria. “A few days ago a whistleblower made an allegation that an organised gang in one of the bases has been working to control the supply of goods to our business there. Not only that, we are paying handsomely for large quantities of goods that do not exist. The suppliers, it’s alleged, are owned by government officials who in return will favour the company with contracts. To make matters more complex, the whistleblower alleges that some of our employees are also among the suppliers’ owners.”

The David Foster Wallace man-on-the-street essays

Should we call them that? These are Wallace’s pieces where he is ostensibly sent to visit and report on some public event. The pieces of writing he returns with are so hard to describe and so quintessentially his, half anxiety-induced inner monologue and half comically observant at the micro level.

Ticket to the Fair, Harper’s Magazine (1994) – David Foster Wallace goes to the Illinois State Fair. Wallace’s description of watching junior baton twirling and amateur clogging are reason enough to read this piece, but there is much more of interest.

Shipping Out: On the (Nearly Lethal) Comforts of a Luxury Cruise, Harper’s Magazine (1996) – See description under the Top 25 section.

The first half of Consider the Lobster – See description under the Top 25 section. Before he tells us why we should consider the lobster Wallace is merely a festival goer at the Maine Lobster Festival.

The work of Chris Jones

I realized I have been reading Jones for a while. He wrote an essay in Esquire back in 2010 that I liked very much, “Roger Ebert: The Essential Man.” Back then I didn’t take note of the author. This year I routinely checked Kevin Kelly’s Top 25 List as I made my way through it. The name Chris Jones stuck in my head. When someone I follow on Twitter (I forget who) suggested “The Woman Who might Find Us Another Earth”, I read it and recognized the byline. I went back and to Kelly’s list and realized it was the same person who had written “The Things That Carried Him.” It made perfect sense, the writing style in the two pieces is so similar. I enjoyed them both so much that I listened to Jones’ Longform podcast episode and when back to read a number of his pieces. I’m happy he has written much more that I have yet to read.

The Woman Who Might Find Us Another Earth, The New York Times Magazine (2017) – One of the most beautiful pieces of writing I’ve ever read. On a woman searching for life on another planet while rebuilding her own on ours.

Home, Esquire (2007) – Two American astronauts are stranded aboard the International Space Station in 2003 after the explosion of the space shuttle Columbia. How will they get home?

The Things That Carried Him, Esquire (2008) – See description under the Top 25 section.

The Big Book, Esquire (2012) – Fascinating profile of Robert Caro who has spent most of his adult life writing a series of books about Lyndon Johnson (I’ve been wanting to read these books for a while now, maybe that will be a goal during an upcoming year!). There is fear he might die before completing the last book. After reading this profile I really hope he makes it through.

The Honor System, Esquire (2012) – Someone has stolen Teller’s trick. It is a beautiful trick. What happens next?

The Contestant Who Outsmarted The Price Is Right, Esquire (2007) – Terry Kniess scored the first exact guess in the Showcase showdown in the 38-year history of The Price Is Right. How did he do it? And then, how did he really do it?

General culture

A High-End Mover Dishes on Truckstop Hierarchy, Rich People, and Moby Dick, Longreads (2017) – A fascinating inside look at the life of a mover whose job is to relocate the wealthy who have millions of dollars of furniture they need to get to their new homes.

Consistent Vegetarianism and the Suffering of Wild Animals, Journal of Practical Ethics (2016) – Argues that to be consistent vegetarians must also desire to reduce wild animal populations by various means.

Rape Choreography Makes Films Safer, But Still Takes a Toll on Cast and Crew, LA Weekly (2017) – An important piece about how Hollywood makes rape scenes safe for women and what happens when they don’t. Also addresses the toll that rape choreography takes on the men and women involved in producing and editing the film.

India’s ‘Phone Romeos’ Look for Ms. Right via Wrong Numbers, The New York Times (2017) – On a group of Indian men looking for love by dialing random numbers and trying to talk to the women who answer. “The “phone Romeo,” as he is known here, calls numbers at random until he hears a woman’s voice, in the hope of striking up a romantic attachment. Among them are overeager suitors (“Can I recharge your mobile?”), tremulous supplicants (“I am talking to you, madam, but my body is shaking”) and the occasional heavy breather (“I want to do the illegal things with you”).”

What Do We Do with the Art of Monstrous Men?, The Paris Review (2017) – Claire Dederer grapples with the idea of terrible men who produce great art.

Did We Change the Definition of ‘Literally’?, Merriam Webster (2017) – “There is no plot by dictionary-makers to destroy our language. There is not even a plot to loosen our language’s morals and corrupt it a bit. There is, however, a strong impulse among lexicographers to catalog the language as it is used, and there is a considerable body of evidence indicating that literally has been used in this fashion for a very long time…The use of literally in a fashion that is hyperbolic or metaphoric is not new—evidence of this use dates back to 1769.”

O’Connor v. Oakhurst Dairy, No. 16-1901, United States Court of Appeals (2017) – What happens when you leave out a comma? “The parties’ dispute concerns the

meaning of the words “packing for shipment or distribution.” The delivery drivers contend that, in combination, these words refer to the single activity of “packing,” whether the “packing” is for “shipment” or for “distribution.” The drivers further contend that, although they do handle perishable foods, they do not engage in “packing” them. As a result, the drivers argue that, as employees who fall outside Exemption F, the Maine overtime law protects them. Oakhurst responds that the disputed words actually refer to two distinct exempt activities, with the first being “packing for shipment” and the second being “distribution.””

Opinion: West Virginia State Board of Education v. Barnette, The Supreme Court – The 1943 decision overturning compulsory flag pledges in public schools:

“It seems trite but necessary to say that the First Amendment to our Constitution was designed to avoid these ends by avoiding these beginnings. There is no mysticism in the American concept of the State or of the nature or origin of its authority. We set up government by consent of the governed, and the Bill of Rights denies those in power any legal opportunity to coerce that consent. Authority here is to be controlled by public opinion, not public opinion by authority.

The case is made difficult not because the principles of its decision are obscure, but because the flag involved is our own. Nevertheless, we apply the limitations of the Constitution with no fear that freedom to be intellectually and spiritually diverse or even contrary will disintegrate the social organization. To believe that patriotism will not flourish if patriotic ceremonies are voluntary and spontaneous, instead of a compulsory routine, is to make an unflattering estimate of the appeal of our institutions to free minds. We can have intellectual individualism and the rich cultural diversities that we owe to exceptional minds only at the price of occasional eccentricity and abnormal attitudes. When they are so harmless to others or to the State as those we deal with here, the price is not too great. But freedom to differ is not limited to things that do not matter much. That would be a mere shadow of freedom. The test of its substance is the right to differ as to things that touch the heart of the existing order.

If there is any fixed star in our constitutional constellation, it is that no official, high or petty, can prescribe what shall be orthodox in politics, nationalism, religion, or other matters of opinion, or force citizens to confess by word or act their faith therein. If there are any circumstances which permit an exception, they do not now occur to us.

We think the action of the local authorities in compelling the flag salute and pledge transcends constitutional limitations on their power, and invades the sphere of intellect and spirit which it is the purpose of the First Amendment to our Constitution to reserve from all official control.

The decision of this Court in Minersville School District v. Gobitis, and the holdings of those few per curiam decisions which preceded and foreshadowed it, are overruled…”

The Top 25

In keeping with the formatting adopted by Kevin Kelly the number of stars represents the number of recommendations.

********** Gay Talese, “Frank Sinatra Has a Cold.” Esquire, April 1966 – Often considered the greatest magazine feature of all time. It’s significant in part because Talese was sent to profile Sinatra, but was not able to interview the subject of the profile. He was thus forced to interview a supporting cast of characters and observe Sinatra from a far. It’s well written, but perhaps my sensibilities have not yet developed to the point of fully appreciating its genius. I much prefer other pieces on this list.

********* Hunter S. Thompson, “The Kentucky Derby is Decadent and Depraved.” Scanlan’s Monthly, June 1970 – A simple assignment to cover the Kentucky Derby turns into a drug-induced haze. The rumor is that Thompson, up against his deadline, started faxing over copies of his notes taken while high at the Derby. The result was the start of Gonzo journalism. I prefer this piece to Thompson’s “Fear and Loathing,” the writing and story are tighter. This is also Thompson’s first collaboration with Ralph Steadman, the brilliant cartoonist who would work with Thompson for the remainder of their careers.

********* Neal Stephenson, “Mother Earth, Mother Board: Wiring the Planet.” Wired, December 1996 – I was always curious about underwater cables. I just couldn’t believe we actually laid communication cables along the bottom of the ocean, because, like, the ocean is really deep. But we do! And this article tells you everything you will ever want to know about the process of laying these cables. It is long, but a really terrific read.

******* David Foster Wallace, “Federer As Religious Experience.” The New York Times, Play Magazine, August 20, 2006 – DFW attempts to describe the genius that is Roger Federer. If you like this article see also Wallace’s other famous piece on tennis, “The String Theory.” I liked both of these pieces, but prefer Wallace’s longer form pieces like “Shipping Out.”

******* David Foster Wallace, “Consider the Lobster.” Gourmet Magazine, August 2004 – In the same way that Hunter S. Thompson was sent to cover the Kentucky Derby for Scanlan’s Monthly 35 years prior and unexpectedly came back with what would become the first ever piece of Gonzo Journalism (“The Kentucky Derby is Decadent and Depraved“), Wallace was sent to cover the Maine Lobster Festival and returned to surprise readers with a thoughtful reflection on the ethics of eating lobster, down to the inner workings of the lobster’s neurological system. Remember again that this was published in Gourmet magazine! Few groups are likely to love lobster more than its readers.

****** John Updike, “Hub Fans Bid Kid Adieu.” The New Yorker, October 22, 1960 – A very famous sports piece about Ted Williams’ last at bat.

***** Hunter S. Thompson, “Fear and Loathing in Las Vegas: A Savage Journey to the Heart of the American Dream.” Rolling Stone. Part I: November 11, 1971; Part II: November 25, 1971 – The article that became a book. Thompson and his lawyer hit Las Vegas to report on the Mint 400 desert rally. Mostly they just do drugs and wander around.

***** Richard Ben Cramer, “What Do You Think of Ted Williams Now?” Esquire, June 1986. Another very famous sports piece about Ted Williams. I actually prefer this piece to Hub Fans Bid Kid Adieu. Made me wish I was there to witness his greatness.

**** Jon Krakauer, “Death of an Innocent: How Christopher McCandless Lost His Way in the Wilds.” Outside Magazine, January 1993 – The article that became “Into the Wild.” I prefer this to Krakauer’s other famous piece, “Into Thin Air” (also on this list). It’s a wildly entertaining piece that also grapples with serious issues about the things we are all searching for in life.

**** Susan Orlean, “The American Man at Age Ten.” Esquire, December 1992. Susan Orlean’s endearing profile of Colin Duffy, a normal ten-year old boy living in Glen Ridge, New Jersey. Perfectly captures the imagination and innocence of childhood and the particular realities that start to dawn on all ten-year olds. If you like this kind of thing check out “A Boy of Unusual Vision” about Calvin Stanley, a ten-year old blind boy in Baltimore. A classic from Alice Steinbach, it won her the 1985 Pulitzer Prize in Feature Writing. Or for something even more serious check out the 2009 Pulitzer Prize winner in Feature Writing from Lane Degregory, “The Girl in the Window.” Be ready to cry.

**** Edward Jay Epstein, “Have You Ever Tried to Sell a Diamond?” The Atlantic, February 1982 – Fascinating piece, perhaps less relevant in 2017, about why diamond’s value is so drastically different if you try to sell one as an individual. Tackles the DeBeer’s monopoly more broadly.

**** Ron Rosenbaum, “Secrets of the Little Blue Box.” Esquire, October 1971 – How an eclectic group of miscreants across the U.S. used various methods to hack telephone lines and get free long distance phone calls. Particularly fascinating if you are old enough to remember when landlines and not mobile phones were the norm. The cast of characters in this piece is just so interesting.

**** Tom Junod, “Can you say…”Hero”?” Esquire, November 1998 – A profile of Mr. Rogers that might just restore your faith in humanity. He really was a hero.

**** Michael Lewis, “The End.” Portfolio, November 11, 2008 – The article that eventually became “The Big Short.” A good piece that I liked, but didn’t love. I had to head to the library to read this piece.

*** George Plimpton, “The Curious Case Of Sidd Finch.” Sports Illustrated, April 1, 1985 – This piece is so amazing and enthralling, but note the date it was written.

*** David Foster Wallace, “Shipping Out: On the (Nearly Lethal) Comforts of a Luxury Cruise.” Harper’s Magazine, January 1996 – To me “Shipping Out” is peak DFW. It’s all on display, Wallace as the gonzo raconteurism, the erudite vocabulary, the nihilism, the portmanteaus (both literary and travel), the epic footnotes.

*** Jon Krakauer, “Into Thin Air.” Outside Magazine, September 1996 – The article that inspired the book. I prefer the article to the book actually. And because of its reduced length it reads much more like an adventure story.

*** Tom Junod, “The Falling Man.” Esquire, September 2003 – This was a reread for me. It’s about the search for one of the most iconic photos from 9-11, a man falling — seemingly with grace like a diver — from one of the top floors of the World Trade Center. Who was this man?

*** Gene Weingarten, “The Peekaboo Paradox.” The Washington Post, Sunday Magazine, January 22, 2006 – Truly fantastic profile of The Great Zucchini, a clown and children’s performer with some secrets.

*** David Foster Wallace, “Host.” The Atlantic, April 2005 – This piece grew on me, but I ended up really enjoying it. It’s a profile of John Ziegler, a Rush Limbaugh-style conservative talk radio host. This piece is expertly researched and has footnotes which sometimes have footnotes and sometimes even those footnotes have footnotes. I recommend reading all of these footnotes. The online version of this piece is out of order. You will start to read the online piece. Everything will seem fine. There are these high-tech expanding footnotes. Then at a certain point a passage stops mid-sentence and another passage begins. The print version is better for reading the footnotes anyway. I had to go photocopy the original from the library.

*** Gene Weingarten, “Pearls Before Breakfast.” The Washington Post, Magazine, April 8, 2007 – As the description goes in Kelly’s list for this piece, “Joshua Bell is one of the world’s greatest violinists. His instrument of choice is a multimillion-dollar Stradivarius. If he played it for spare change, incognito, outside a bustling Metro stop in Washington, would anyone notice?” This piece won Weingarten the 2008 Pulitzer Prize in Feature Writing.

*** Chris Jones, “The Things That Carried Him.” Esquire, May 2008 – As the description goes in Kelly’s list for this piece says, “It’s extremely moving without being saccharine or twee. It’s a military story, but utterly without jingoism or indictment. And it’s wonderfully observed.” This piece is told in reverse chronological order, which works perfectly. The care and honor with which the U.S. military treat their dead is really something to behold. It makes you wonder about what you want done with your own body after death.

*** Michael Lewis, “Wall Street on the Tundra.” Vanity Fair, April 2009 – Another piece I couldn’t find online and had to hit the library to read. An account of how tiny Iceland and its cast of characters found its way to the center of the global financial crisis. “This in a country the size of Kentucky, but with fewer citizens than greater Peoria, Illinois. Peoria, Illinois, doesn’t have global financial institutions, or a university devoting itself to training many hundreds of financiers, or its own currency. And yet the world was taking Iceland seriously.”

*** Gene Weingarten, “Fatal Distraction: Forgetting a Child in the Backseat of a Car Is a Horrifying Mistake. Is It a Crime?” The Washington Post, March 8, 2009 – Weingarten won the 2010 Pulitzer Prize in Feature Writing for this piece. Accidentally leaving a child in the backseat of a car kills more children than you think. Often times the parent is prosecuted for child negligence. For many it doesn’t matter, their grief and regret is overwhelming. Others try to move on and use the tragedy as a tool for change. And if you think this can’t happen to you — that you would never forget your child — trying reading this piece and then see what you think.